child care tax credit calculator

Calculating the Child and Dependent Care Credit until 2020. Heres how to calculate how much youll get.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

To calculate your childcare tax credit multiply your expenses by the rate of your family income tax.

. The payments for the CCB young child supplement are not reflected in this calculation. The American Rescue Plan. First the new law temporarily increases the credit amount from 2000-per-child to 3000-per-child 3600 for children 5 years old and younger for the 2021 tax year.

The expanded child and dependent care credit allows eligible. Prior to the american rescue plan parents could only claim 35 of a maximum of 6000 in child care. The new child tax credit will provide 3000 for children ages 6 to 17 and 3600 for those under age 6.

Families with children are now receiving an advance on their 2021 child tax credit. Child Tax Credit Calculator for 2021 2022. Child and Dependent Care Credit Value.

As the calculator shows the expanded CDCTC for 2021 significantly increases the amount families can receive when they file their taxes for 2021. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The credit is calculated.

Ad The new advance Child Tax Credit is based on your previously filed tax return. The child tax credit is a credit that can reduce your Federal tax bill by up to 3600 for every qualifying child. Our child tax credit calculator tells you how much money you might receive in advance.

Check what help you might be able to get with childcare schemes like tax credits Tax-Free Childcare childcare vouchers and free childcare or education for 2 to 4-year-olds. The child tax credit. File a free federal return now to claim your child tax credit.

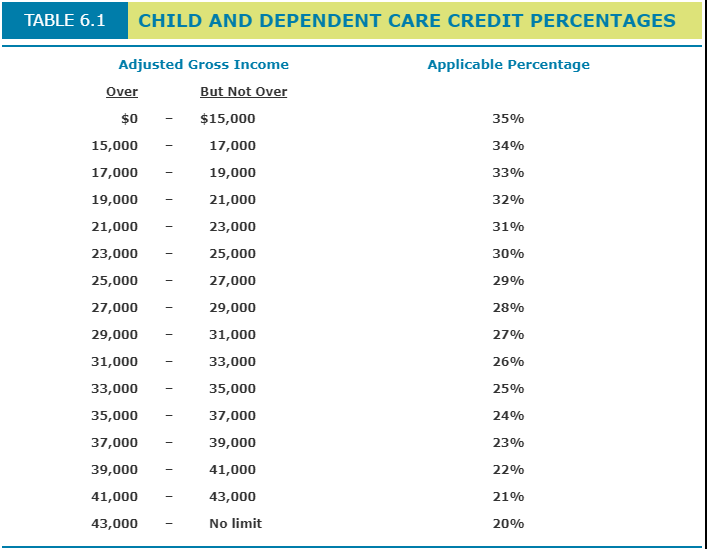

The percentage depends on your. Costs at the kindergarten level such as nursery school can. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100.

The percentage you use. Your Working Tax Credit or Child Tax Credit will stop straight away if you successfully apply for Tax-Free Childcare. The Child and Dependent Care Credit can be worth from 20 to 35 of some or all of the dependent care expenses you paid.

Child care tax credit calculator How do you calculate a child tax credit. Approximate value of fully utilizing the Dependent Care Tax Credit in 2021. Up to 3600 per qualifying dependent child under 6 on Dec.

Sometimes before and after-school programs qualify but it must be for the care of the child rather than just leisure. Up to 3000 per qualifying dependent child 17 or younger on Dec. You must tell your employer.

The advance Child Tax Credit Calculator will provide you with the estimated credit amount you can expect as your Child Tax Credit for 2021. You can use this calculator to see what child. For tax years through 2020 the Dependent Care Credit is 20 to 35 of qualified expenses.

Child and family benefits calculator. You will need to provide the number of children. For the 2021 tax year the child tax credit offers.

Form 2441 should be filed along with your 2021 tax return to take advantage of the Dependent. The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons.

Politifact Advance Child Tax Credit Payments Won T Usually Require Repayment

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Canada Child Benefit The Hidden Tax Rate Planeasy

Child Tax Credit Update How Will Ctc Affect Your 2022 Tax Returns Marca

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

2021 Health Insurance Marketplace Calculator Kff

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Credit Definition How To Claim It

Calculate The Amount Of The Child And Dependent Care Chegg Com