jersey city property tax rate 2020

It was lower than the 2 percent cap former Gov. County Equalization Tables.

New York Property Tax Calculator 2020 Empire Center For Public Policy

1 Since 2018 the state of NJ has reduced 155 million of education aid to Jersey City.

. On average the states property taxes rose 212 percent to 8953. The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019. My wife and I are in the process of buying a condo and I was trying to project the property taxes for the year.

Left click on Records Search. This is the total of state county and city sales tax rates. Per Jersey City Ordinance 18-133 all employers located within Jersey City are subject to a 1 tax on their gross payroll.

This rate includes any state county city and local sales taxes. The final rate of 148 has been officially certified by the board a tad below the 162 estimate that had been given to residents. See Live New Jersey House Election Results and Maps by state county and district from NBC News.

Mayor Steve Fulop hailed the news on Twitter. New Jersey Property Taxes Go To Different State 657900 Avg. Essex Countys distinction Property owners in Essex.

587 rows The General Tax Rate is used to calculate the tax assessed on a property. I can confirm that 161 is correct but much like. 10 25 50 75 100 All.

6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35. And last year the average tax bill in the state climbed to 8953. The average 2020 New Jersey property tax bill was 8893 an increase of.

The New Jersey sales tax rate is currently. Thats an increase of 186 over what Jersey homeowners paid on average in 2018 and an increase of. The latest sales tax rate for Jersey City NJ.

Under Tax Records Search select Hudson County and Jersey City. All tax revenues will support the City of Jersey City public schools. I ran into the same issue recently.

The data released this past week comes from the state Department of Community Affairs. 2020 rates included for use while preparing your income tax. Average Effective Property Tax Rate 2020 Atlantic County.

Overview of New Jersey Taxes. Chris Christie put into. And while the average property tax bill in.

The general tax rate is used to. The Garden State is home to the highest levies on property in the nation with a mean effective property tax rate of 221 according to the Tax Foundation. New Jerseys average tax bill crossed 9000 for the first time in 2020 coming in at 9112.

1 day agoNew Jersey House Election Results for the 2022 primary election. 189 of home value Tax amount varies by county The median property tax in New Jersey is 657900 per year for a. But plenty of Garden State taxpayers are already paying quite a bit more.

On average the states property taxes rose 1 percent from 8953 to 9112 between 2019 and 2020. The average local property-tax bill went up last year by 19 over 2020s total of 9112 according to the states data. Homeowners in New Jersey pay the highest property taxes of any state in the country.

252 551721 252 05 252 51 252. It is equal to 10 per 1000 of taxable assessed value. Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel.

This was state-driven pressure to increase the school tax in Jersey City. The minimum combined 2022 sales tax rate for Jersey City New Jersey is. In fact rates in some areas are more than double the national average.

Tax Information City Of Katy Tx

Pin By Mahammadu Tokara On Steel Structure Architecture Building Design Prefab Buildings Facade Design

It Looks Like Detroit Was Suckered By Amazon Hq2 Move Here S How Northern Virginia Crystal City Long Island City

7 Tax Benefits Of Owning A Home A Complete Guide For Filing This Year Home Ownership Home Buying Tips Real Estate

State Local Property Tax Collections Per Capita Tax Foundation

New Zillow Study Details Rental Cost Disparity Of City Vs Suburbs Real Estate Tips Zillow Suburbs

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Tax Bill Breakdown City Of Woodbury

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

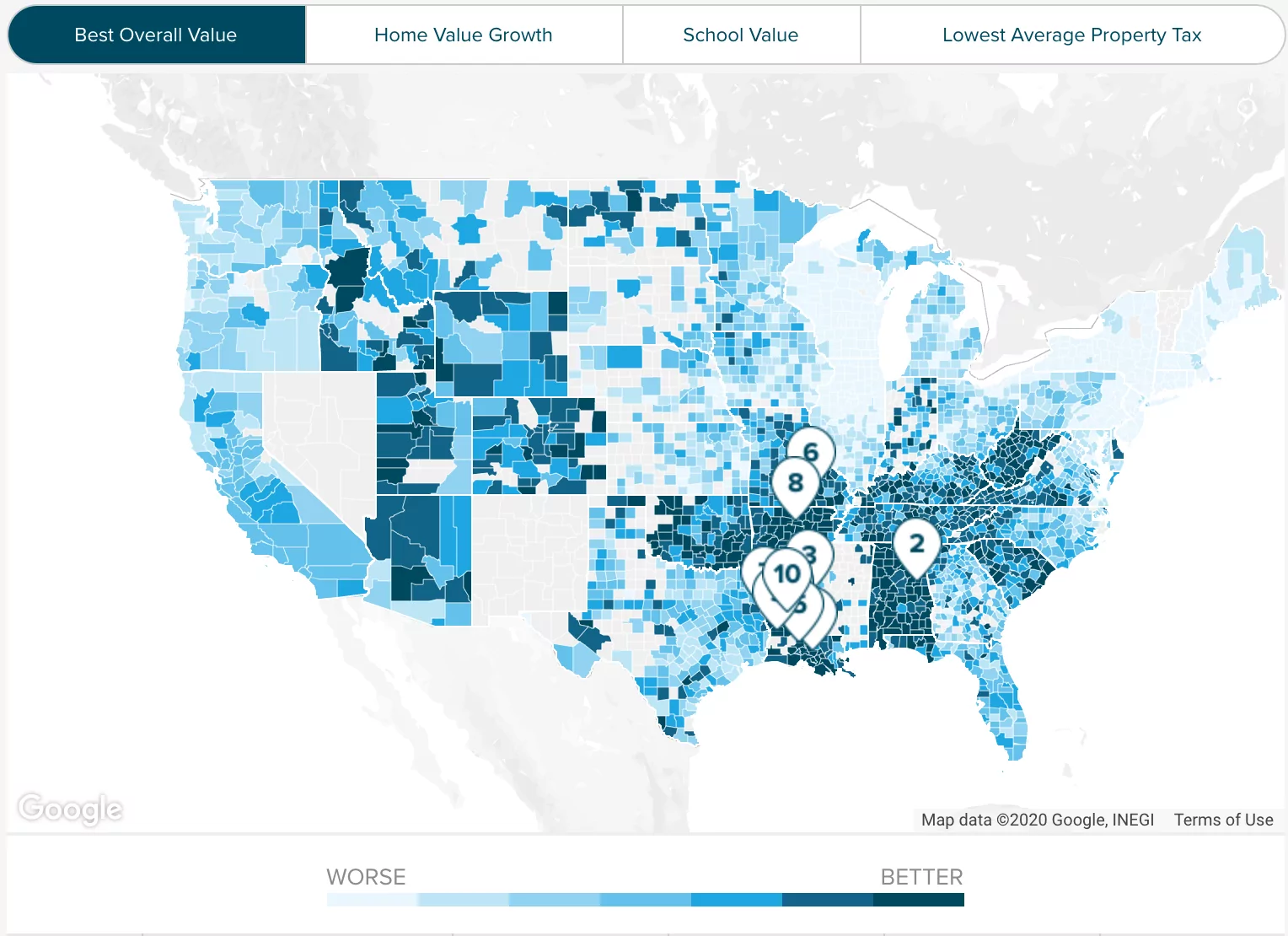

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom