portability real estate taxes florida

In the previous example if the homeowner purchases a larger home with a justmarket value of 300000 portability allows for a reduction in taxable value by the 58000 cap value accrued on the. If you do not have property in Martin County enter 0 in both the Market Value and Assessed Value fields.

Florida Homestead Check For Homeowners

If our office denies your portability application you will have an opportunity to file an appeal with Palm Beach Countys Value Adjustment Board.

. Previous Save Our Homes Difference DIVIDED by Previous Market. The average property tax rate in Florida is 083. If a homestead property is sold or transferred in calendar year 2022 the homestead tax benefits including the Cap Benefit remains with that property until December 31 2022.

On the Real Estate Tax Bill or use the parcel record search. 1 It applies solely to homestead changes in 2007 or later. Cap Ratio MULTIPLIED by New Market Value.

4 A person does not need to acquire a new homesteaded residence to qualify. Before portability came along some homeowners wouldnt consider a move because they didnt want to lose their low tax bills. With portability they can take the savings with them up to a maximum of 500000.

Lets say your new home has a market value of 300000. Once you have completed part 1 2 print the form sign it Part 3 and return it to. The homestead exemption reduces the taxable value of a property Ballotpedia said.

You can see tax rates by county either summarized on the Florida CFO page or. If you are moving from a previous Florida homestead to a new homestead in Florida you may be able to. You have a 100000 benefit from your previous homestead.

However property taxes will not be subject to refunds for previous years Section 193155 8k Florida Statues. This reduces the assessed value of your new homestead property which reduces your taxable value and saves you money. If you moved to Hillsborough County from another Florida County provide the most complete address you can and be sure to include the name of the County.

Portability is effective throughout the state. Save Our Homes Portability Transfer. All Market Values in the above scenarios are.

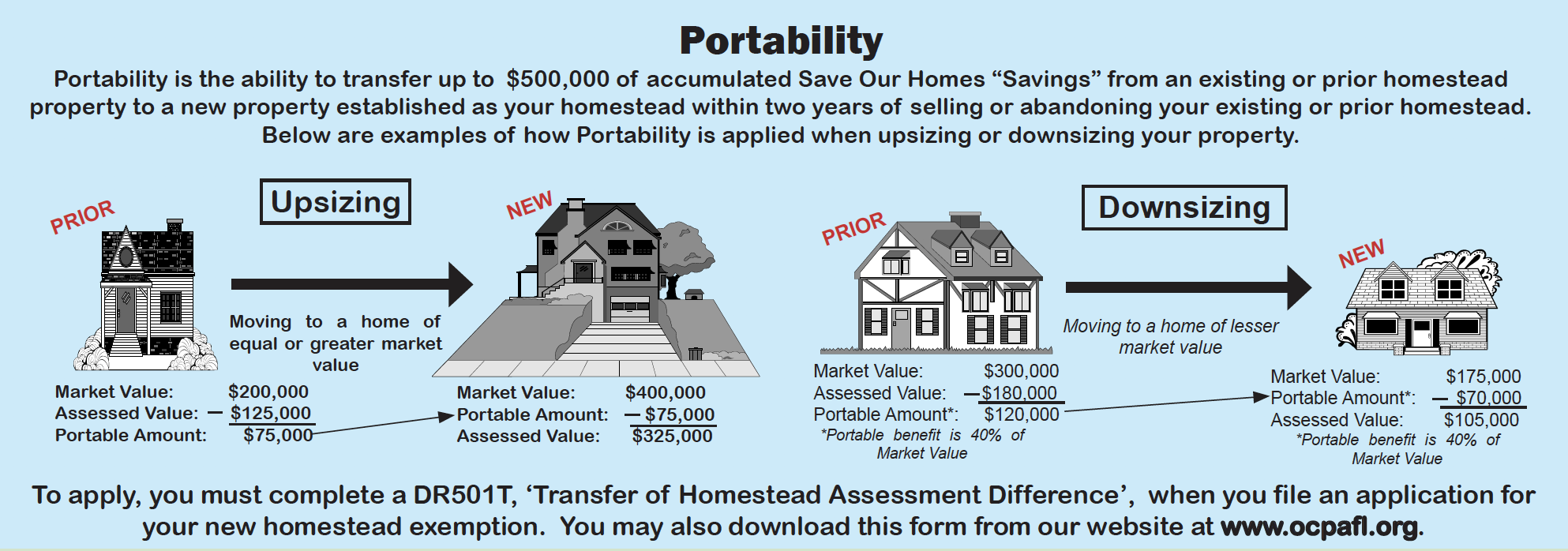

Previous Property selling or sold To find your current market value or assessed value click here for details. 3 500000 is the maximum cap that can be applied to the new homestead. Portability is the ability to transfer up to 500000 of accumulated Save Our Homes assessment difference from a prior Florida homesteaded property to a new homesteaded property in Florida.

Would your CAP amount be portable if you move to another county in Florida. The assessed value will never be more than the just value of your home. Florida property owners can receive a 25000 property tax exemption for their primary residence.

There are also special tax districts such as schools and water management districts that have a separate property tax rate. For any questions contact our Portability staff at 5613552866 for more information. Subscribe And Save More At CPA Self Study Online.

An additional 25000 homestead exemption is applied to homesteads that have an assessed value of more than 50000. If your portable amount is 75000 times the calculated rate of 60 your portable deduction amount for would be 45000. 04 x 200000 PORT 80000.

Florida Statutes Even if the value of your home decreases the assessed value may increase but only by this limited amount. Portability benefits may be reduced if the benefit is split among multiple homestead owners and is limited to 500000. Will be applied to the assessed value of the new homesteaded property in the year that the portability is first approved.

Portability went into effect on Jan. When buying real estate property do not assume property taxes will remain the same. Learn With CPA Self Study.

2 At least one owner from the previous homestead property must be an owner of the new homestead property. How does homestead portability work. 247 Access To More Than 130 Courses.

The assessed value of your new home will be 200000. Market and assessed values can be found on any Florida Countys Notice of Proposed Property Taxes. 1 2008 and has become important given the decade-long runup in Florida property values.

These can include fixed-amount non-ad valorem assessments. Hillsborough County Property Appraiser. Learn Tax Consultant Certification - Best Tax Consulting Training - Free Tax Questions.

Ad Our free guide may help you get the facts before taking the dive. Ad Practical And Affordable CPE Courses For CPAs. Apply for Portability when you apply for Homestead Exemption on your new property.

Each county sets its own tax rate. Ad Free Online Tax Tutorial - Tax Consultant Certification - Be Certified Tax Consultant 100. In Florida Property Tax Portability refers to the ability to transfer up to 500000 of accumulated Save Our Homes Cap Savings from an existing or prior homestead exempt property to a new property established as your homestead within two tax years of selling or abandoning your existing or prior homestead.

This means the homestead property owner has until January 1 2025 in order to complete the Portability process for the new homestead property. If you already own another property 2nd home beach house etc and establish your new homestead you can remove abandon the homestead from the old property and apply for the portability benefit. Homestead portability allows the transfer of homestead assessment benefits from your previous homestead property to your new home.

For example if the Prior Homes Market Value is 250000 and the New Homes Market Value is 150000 the rate would be calculated at 150000 250000 or 60. The Florida Department of Revenue breaks. 100000250000 Cap Ratio 04.

Video by Tommy Forcella 10252017.

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Understanding Florida S Homestead Exemption Laws Florida Realtors

/arc-anglerfish-arc2-prod-tbt.s3.amazonaws.com/public/R76EFPWHBMI6TBKNIBWI6S7HAY.jpg)

Portability Benefit Can Reduce Tax Burden For Property Owners Moving Into Larger Or Smaller Homes

Florida Property Taxes Explained

Real Estate License Reciprocity Portability Guide

Estate Planning With Portability In Mind Part Ii The Florida Bar

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

What Is Florida Homestead Portability Epgd Business Law

How Rising Property Values Could Impact Your Property Tax Bill Nbc 6 South Florida

Florida Tax Portability Easy Explanation With Lisa Fox Youtube

Irs Now Allows For 5 Year Estate Tax Portability Election

What Is Homestead Exemption In Florida Rules Explanation Kin Insurance

Homestead Portability Transferring Your Florida Homestead Cap To Your New Home Infinity Realty Group

Estate Planning With Portability In Mind Part Ii The Florida Bar

Southwest Florida Real Estate Taxes Southwest Fl Dave Sage Brenda Boss Sagerealtor Com